Territorial governors: Tread lightly on tax reform

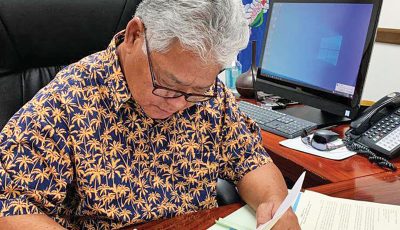

Gov. Ralph DLG Torres joined the governors of other U.S. territories to press the U.S. Senate for a separate title to address taxes on territories.

In a letter dated Aug. 30, 2017, Torres, Gov. Lolo M. Moliga of American Samoa, Gov. Edward B. Calvo of Guam, and Gov. Kenneth E. Mapp of the U.S. Virgin Islands reminded the U.S. Senate that even the slightest of federal tax policy changes could greatly affect each territorial economies.

This came as U.S. Congress begins efforts to reform the U.S. tax code “in order to create American jobs and spur economic growth”

The letter was addressed to U.S. Senate Committee on Finance chair Sen. Orrin Hatch (R-UT) and ranking member Sen. Ron Wyden (D-OR), along with U.S. House Committee on Ways and Means chair Rep. Kevin Brady (R-TX) and ranking member Rep. Richard E. Neal (D-MA).

“It is … increasingly clear that restrictive and ill-considered tax policies, a ‘one-size-fits-all’ approach can also negatively impact economic growth, reduce job opportunities, and create fiscal instability for our governments,” reads part of the letter.

In line with this, a “separate title or subtitle for the territories in any tax reform bill considered by the tax-writing committees” should be looked.

“[These] would include special rules for economic growth and jobs creation in these American, but often neglected, areas,” they stated.

The letter cited the bipartisan Congressional Task Force on Puerto Rico, which noted that Congress must “be mindful” that Puerto Rico and the other territories are U.S. jurisdictions…“home to U.S. citizens or nationals, and that jobs in Puerto Rico and the other territories are American jobs.”

The letter also specified that the territories are “generally considered foreign tax jurisdictions,” making it essential that the U.S. income tax system treat the territories “more favorably” than foreign jurisdictions and “include special rules to empower the territories to meet the unique fiscal and economic challenges each territory faces.”

The U.S. House approved the U.S. fiscal year 2018 budget last Oct. 5, 2017, with elements to assist the advance of a tax bill. Republicans in Congress seek to enact tax cuts for corporations, small businesses, and individuals. President Donald J. Trump, along with several top Republicans in Congress, seeks to enact the cuts before January 2018 while federal officials claim that the cuts would induce a short-term surge and would soon be defeated by inflation and possibly recession.