Obama administration supports Kilili position on Earned Income Tax Credit

The Obama administration told Congress this week that it wants the Northern Mariana Islands, American Samoa, Guam, Puerto Rico, and the U.S. Virgin Islands all included in the Earned Income Tax Credit program. This is a change in administration policy, which before supported extending federal help for low-income working families only in Puerto Rico.

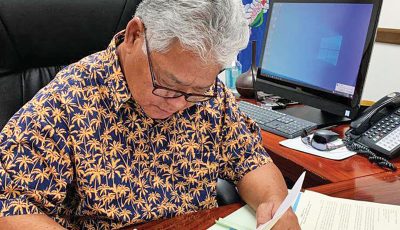

The new Obama position is consistent with legislation introduced by Delegate Gregorio Kilili Camacho Sablan (Ind-MP) last year that provides federal funding for the tax credit to all the U.S. insular areas.

“This is very good news,” Sablan said. “The Earned Income Tax Credit is paid to people who have low-wage jobs. So it boosts household income and puts more money into the local economy.

“And because you have to be working to get this tax refund, it also encourages people to find jobs, which should help our effort to hire more U.S. workers.”

Sablan’s bill, H.R. 4309, works the same way as the Child Tax Credit that is already available in the Northern Marianas. Taxpayers apply for the credit on their annual NMI income tax form. The U.S. Treasury then gives the money to the Commonwealth Finance Department to cover the cost. Finance distributes the credit by check in the Marianas.

The President proposed extending the EITC to Puerto Rico in his fiscal year 2017 budget this February, as a way to respond to the debt crisis there: “To reward work … the budget proposes an EITC for Puerto Rico. The EITC is already available to Americans living in the 50 States and the District of Columbia, and providing the EITC in Puerto Rico would create incentives for work and increase participation in the formal economy.”

But the Northern Marianas and the other three insular areas were left out.

Sablan and the other insular area delegates who cosponsored his Earned Income Tax Credit bill—Amata Radewagen (R-American Samoa), Madeleine Z. Bordallo (D-Guam), and Stacy Plaskett (D-Virgin Islands)—have been actively lobbying the Obama administration to add their islands to any bill that extends the EITC to Puerto Rico. Resident Commissioner Pedro Pierluisi (D-Puerto Rico) is also a cosponsor of Sablan’s bill.

The Earned Income Tax Credit provision is not expected to be part of the Puerto Rico debt crisis bill now being drafted by the House Natural Resources Committee in preparation for a hearing and mark-up next week. But the new administration position adds weight to the effort to include the EITC—and improve how Medicaid covers the insular areas—in follow-up legislation in this Congress.

The administration’s new position was part of testimony by the Interior Department at a Senate Energy and Natural Resources Committee hearing this week. In that statement, Interior said: “The Department believes that the other territories should be considered for inclusion in the health and tax provisions that may be extended to Puerto Rico.

“This would equalize treatment among the territories and the states as well as take steps to prevent a crisis, based on unequal treatment, from developing in the other territories,” Interior added.