NMIA celebrates 40 years of serving the CNMI

The Northern Marianas Insurance Association is celebrating its 40th anniversary this year and association president Gol Corpuz is proud to share that the group continues to make a difference in the lives of their clients as well as the wider CNMI community.

“We are going strong at 40 and we expect to continue growing and contributing our time and resources both to our members and to the community, especially after calamities and during their time of need,” said Corpuz.

Under its bylaws, NMIA considers itself a non-profit organization, which was primarily created with the goal of fostering the professional, social, and educational association of insurance companies, general agents, sub-agents, brokers and adjusters doing business in the CNMI.

Composed of 12 insurance companies that operate in the Northern Marianas, they provide the CNMI insureds with a varied list of insurance products ranging from automobile, health, homeowners, personal accident, and bonds, to workers’ compensation, among others.

Advocacy

While it is primarily meant as a social group, the NMIA’s greatest work can best be considered its ability to work with policy makers by introducing reforms in the civil justice system as well as in improving current policies and legislation that affect the local insurance sector and CNMI insureds.

Throughout its existence, the NMIA has been particularly instrumental in assisting the Department of Commerce in providing guidelines toward the implementation of significant legislation, which includes Public Law 11-55, which is the Mandatory Liability Auto Insurance Act.

Corpuz said the enactment of this law serves as a safeguard for innocent third-party victims injured by a motorist to recover medical or even death expenses by making insurance coverage a mandatory insurance requirement. This law also provides that vehicles cannot be registered without the vehicle owner securing a mandatory liability insurance of $15,000 per person/$30,000 per accident for bodily injury and $15,000 per accident for property damage in place.

Additionally, with help from the NMIA, the enactment of public laws on “No Direct Action,” “Bad Faith” and “Capping Non-Economic Damages at $300,000” has helped lessen litigations, which is good for both the industry and the insuring public as it minimizes the spending of funds and resources through unnecessary litigation costs.

Building a strong working relationship not just among members but especially with industry stakeholders is quite important to the organization.

“We develop and sustain relationships with legislators and policy makers by inviting them to our NMIA meetings as guest speakers. Occasionally, our association joins government-sponsored events like beautification programs and exhibits to network and to sustain our working relationship with them,” said Corpuz.

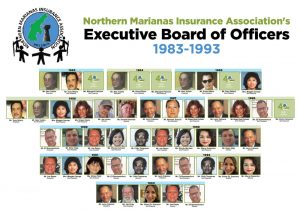

NMIA’s founding members

It was the need to provide insurance coverage to local businesses that paved the way for the creation of the first insurance company in the CNMI. In 1962, businessman Edward Milne came to Saipan and put up the first Joeten village stores. When he could not find insurance coverage for these stores, Milne joined forces in 1965 with established businessmen Jose C. Tenorio, Manny Villagomez, Olympio T. Borja, Lorenzo Guerrero, Herman “Pan” Guerrero and former governor Pete P. Tenorio and established the Micronesian Insurance Underwriters Inc. It was MIUI that came to be the first insurance underwriter from the Northern Marianas that operated business in the Micronesian region, selling life insurance policies. Later, it merged with the Guam-owned Moylan’s Insurance Underwriters Inc.

It took 18 years after the CNMI’s first insurance company was established for Public Law 3 -107 or the Commonwealth Insurance Act of 1983 to be enacted. The creation of the Insurance Commissioner’s Office under the CNMI Department of Commerce through Public Law 3-107 served as the impetus for the creation of the NMIA.

Banding together to address the lack of tort reforms at that time to protect both the insurance industry and the insuring public, a small group of insurance professionals founded the NMIA.

The first NMIA board of directors had Alex Tudela, the co-owner of Equitable Insurance, as its president, with Tony Peters as his vice president, while Margaret Palacios acted as the group’s secretary. On its second year of existence, Edward Milne was elected vice president of the board. Today, industry pioneer Maggie George is still active as the owner of Associated Insurance Underwriters. Currently, the NMIA board represents a good cross-section of the local insurance sector.

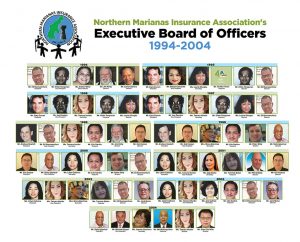

The original members may have been limited to representatives of property and general agents, but it has evolved to a more diverse membership that includes domestic, foreign, and alien insurers, agents, adjusters and brokers.

From its humble beginnings, the NMIA grew steadily through the years. “It took a lot of hard work for the NMIA pioneers to come together as a group. Inadequate funding and what seemed was a lackluster government support were not a deterrence, so they pushed through. We would not have reached our level of maturity today without the initiative of our founding members,” said Corpuz. “Today, the NMIA continues to live up to its goal of listening to the concerns of member companies and finding solutions to these concerns. As a group, they make it a priority to offer advice to members and draw on and benefit from each other’s expertise as well as international communities.”

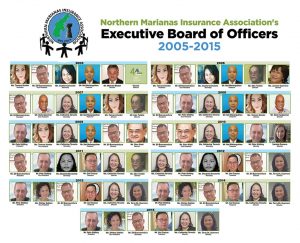

This relationship among NMIA members has given them the ability to respond to changing times and needs.

Corpuz is himself a 35-year veteran of the local insurance sector and a four-time NMIA president. Between holding the organization’s presidency, Corpuz also held various posts, from being vice president, a 10-term treasurer and as director of the group, which he served twice.

Under his leadership, the NMIA continues to maintain its link with lawmakers and policy makers within the Department of Commerce, the Insurance Commissioner’s Office, and the Worker’s Compensation Commission Office.

According to Corpuz, the NMIA’s current priorities include “working on revisions to the Workers Compensation and Automobile Tariff law as well as adjusting benefits and limits that are fair and reasonable to both insurers and the insuring public.”

Community involvement

Undoubtedly, the insurance sector of any community makes a significant contribution particularly in the form of taxes, funding, and investments in the local economy.

In recent years, with the spate of back-to-back super typhoons that hit the islands, the local insurance sector has been very busy acting with urgency to help the insureds get back on their feet, either through the reconstruction of homes or resumption of businesses.

As an extension of their core business, Corpuz said community involvement is important to them. “It is our way of giving back to the insuring public, aside from paying their claims to recover their losses,” he said.

Northern Marianas Insurance Association officers pose in front of a bus stop they adopted and spruced up.

Northern Marianas Insurance Association Insurance and OSHA Safety Training at the Saipan World Resort in 2022.

The Northern Marianas Insurance Association donates to the American Red Cross-NMI Chapter after Super Typhoon Yutu.

The Northern Marianas Insurance Association donates to Karidat Social Services after Super Typhoon Yutu.

Corpuz said the NMIA has partnered with the American Red Cross-NMI Chapter, Karidat Social Services, and the Salvation Army through monetary donations benefiting the community, especially after super typhoons Soudelor and Yutu. Individual members of the group have also donated separately for disaster relief.

But more than the help they give after a disaster, the NMIA proactively participates in supporting educational and scholarship grants given through the Northern Marianas College, said Corpuz. These scholarships are meant to encourage students to work in the CNMI, particularly in the insurance sector. The NMIA plans to introduce this same program at Marianas High School by school year 2024.

Another key educational initiative that the NMIA invests in is its collaboration with the CNMI Public School System. Dubbed as the “Master of Disaster” this 2001 initiative provides public school students from kindergarten to junior high school the skills and the preparedness ability to act on urgent situations and disasters. The group also makes disaster preparedness literature readily available to everyone in the community with the dissemination of hand-outs and brochures.

NMIA members can take advantage of regular seminars and training, the most recent of which is on general insurance practices on safety and OSHA general industry safety standards and guidelines. This training in March 2022 was organized in partnership with the Occupational Safety and Health Administration and was attended by over 30 professionals in the insurance, construction, and other industrial fields.

Access to shared information is another advantage NMIA members enjoy but Corpuz emphasizes that safety and caution remains paramount, especially when confidentiality of information is to be considered, “Each member company has their own insurance system and mobile app that works for them. Sharing claims information is welcome among members, particularly when a customer transfers from one company to another. The association, however, is mindful about the confidentiality of information of our clients. While technology is a must in our day and age for efficiently servicing clients, it must be balanced with caution because of cyber risk while protecting the client’s confidential information,” said Corpuz.

Access to information also means that NMIA members are given notice of any ongoing bills that may affect the insurance industry. Tariff as formulated by NMIA and approved by the Department of Commerce and the Insurance Commissioner’s Office are only shared to group members.

In keeping with the times, the NMIA in May 2022 launched its website, where the insuring public can access and inquire online about their insurance concerns—both for the group or for individual members. Email addresses and contact numbers of each member company are also linked and available on the site, in case there is a need for information about, and from, a specific company or about the insurance association.

NMIA and the future

As the NMIA inches toward a new year in its history as a collective voice for the local insurance sector, Corpuz sees the group continuing its role as a major voice in catering to and promoting fair and reasonable insurance practices in the CNMI. “Our focus will remain connected to our charter and bylaws and continue the legacy and intent of our founding members,” he said.

The NMIA’s immediate and future plans include assisting the office of the Insurance Commissioner in adjusting the tariff for the Workers Compensation of 1989 and the Auto Tariff of 1999. Both tariffs are currently not on par with the current wages and conditions of the market. “We will also be working with our legal counsel and our lawmakers to ensure that these proposed changes in the insurances laws will gain legislative approval,” said Corpuz.

While changes in government, which include policy and policymakers, may be a challenge to manage, the NMIA will remain apolitical to ensure that the interest of the industry is protected, the NMIA president said.

Most importantly. the NMIA will continue its community outreach programs focusing on insurance education, creating awareness within the insuring public about risk and catastrophe, as well as charitable contributions as the group’s funds may allow.