Green card holders, CWs eligible for ‘stimulus check’

Legally employed workers who reside and work in the CNMI—such as green card holders and those with work visas such as CW, H-1B, H-2A—are eligible to receive a refundable tax credit, widely known as “stimulus checks.”

According to the guidance released by the Office of the Governor last Wednesday, non-U.S. citizens qualify for the stimulus checks as long as they are “living and working in the U.S.” and have a valid Social Security number.

Visitors and people who are in the U.S. illegally are excluded in the provision.

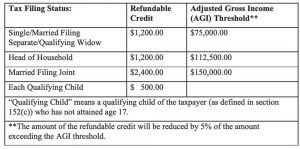

The CNMI was given access to the 2020 Recovery Rebates for Individuals, through the Coronavirus Aid, Relief, and Economic Security Act that was enacted last March 27. It provides up to $1,200 for eligible individuals, or up to $2,400 for joint returns, and $500 additional for each qualifying child.

Stimulus checks will be issued via direct deposit, or by check mailed to the address indicated on the individual’s 2018 income tax return, if the 2019 ITR has not been filed yet, or the individual’s last known address. Taxpayers will not be contacted to provide bank account information.

To benefit immediately from this stimulus, an individual must have at least filed an income tax return for 2018.

Finance Secretary David DLG Atalig said that the stimulus package would assist every family in the Commonwealth and is great news, especially as the CNMI weathers the economic downturn due to the COVID-19 pandemic.

Atalig also expressed appreciation to the Division of Revenue & Taxation for working tirelessly to ensure taxpayers in the CNMI get the much-needed federal stimulus.

“This relief comes at a much-needed time, and I thank President Trump and the U.S. Congress for their work in taking care of the country, particularly their support of the CNMI, one of the hardest hit American communities as a result of the global outbreak of COVID-19,” Gov. Ralph DLG Torres said.

The Office of the Governor is encouraging all residents with income, earned or unearned, to file a tax return, “especially pensioners and other individuals who typically do not have a filing requirement (income amounts equal to or less than the standard deduction amount allowed).”

Additional public guidance will be released by the Department of Finance prior to the disbursement of the stimulus checks.