Finance provides guide on ‘stimulus checks’

On March 27, 2020, President Donald J. Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act. The CARES Act includes provision for a refundable tax credit, widely known as a “stimulus check” that applies to the CNMI and other U.S. territories.

“This relief comes at a much-needed time, and I thank President Trump and the U.S. Congress for their work in taking care of the country, particularly their support of the CNMI, one of the hardest hit American communities as a result of the global outbreak of COVID-19,” said Gov. Ralph DLG Torres.

“I would like to thank the team at the Division of Revenue & Taxation for working tirelessly in making sure our taxpayers get the federal stimulus we all need and can use. I know this would assist every family in the Commonwealth and is great news especially as we weather this economic downturn due to the Covid-19 Pandemic,” said Finance Secretary David DLG Atalig.

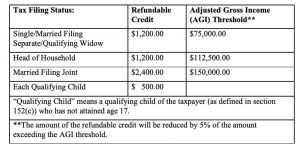

The refundable credit provides up to $1,200 or $2,400 for joint returns for eligible individuals, and $500 additional for each qualifying child.

Any individual is eligible for this refundable credit. This generally includes legally employed workers who reside and work in the CNMI, such as green card holders and those on work visas, such as a CW, H-1B, or H-2A.

To benefit immediately from this stimulus, you must have at least filed an income tax return for 2018. We encourage all residents with income, earned or unearned, to file a tax return; especially pensioners and other individuals that typically do not have a filing requirement (income amounts equal to or less than the standard deduction amount allowed).

The Department of Finance, Division of Revenue & Taxation is developing the best methodology to maximize the amount of stimulus funds to be requested by the CNMI for advance payment to taxpayers.

Taxpayers who have not yet filed their 2019 returns, will be substituted with their 2018 return information.

Stimulus checks will be issued via direct deposit or by check and mailed to the address indicated on the return, or last known address. Taxpayers will not be contacted to provide bank account information. The Department of Finance will provide additional public guidance before disbursement.

Income tax deadline

The CNMI, as a mirror U.S. income tax code jurisdiction, will adopt the income tax filing extension deadlines announced by the U.S. Internal Revenue Service from April 15 to July 15, 2020. This extension applies to all individual returns, trusts and corporations. This extension is automatic. Taxpayers do not need to file any form to obtain the extension.

Although the filing deadline is now July 15, we encourage those taxpayers that are eligible for additional child tax credit (ACTC) to file as early as possible so that their ACTC refund can be processed early and their refund check, if any, be received sooner.

To assist taxpayers in social distancing efforts, the Division of Revenue & Taxation is providing a tax return dropbox at the entrance of the office for easy and fast submission of tax forms.

Taxpayers are encouraged to visit the Department of Finance website at www.dof.gov.mp/forms to access digital versions of the required tax forms. If you have any questions or concerns, you may send an email to info@dof.gov.mp and a response will be sent as soon as possible. (PR)