Cruz questions general fund tax revenue reported in April 2016

»$9.3.M withholding tax revenue from GMHA recorded

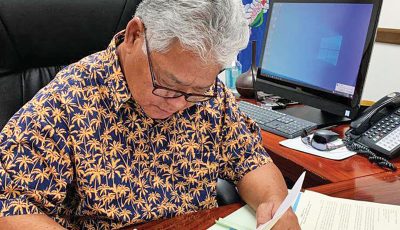

HAGÅTÑA—Determined to ensure that monthly financial reports detailing the state of GovGuam’s finances are accurate, honest, and accountable—appropriations chair Vice Speaker Benjamin J. F. Cruz is calling on the Department of Administration (DOA) to explain whether the government’s recognition of $9.3 million dollars for the month of April in withholding revenue was collected in actual cash, or was merely a paper entry used to improve the appearance of the most recent Consolidated Revenue and Expenditure Report (CRER).

In a letter transmitted to DOA Director Christine W. Baleto this morning, Cruz highlights that the oldest of GMHA’s Income Tax Withholding receivables date back to October 2015, affecting the appearance of the April 2016 CRER.

“I want to ensure that we are not over-representing what was actually collected in April—which is supposed to be our banner month each fiscal year—in terms of cash collections,” explained Cruz. “We owe it to the people of Guam to provide the most accurate information possible in these government financial reports.”

Cruz’s letter was issued upon the appropriations chair’s examination of the overdue April 2016 Consolidated Revenue and Expenditure Report (CRER), which was submitted to the Legislature after the Vice Speaker sent a Freedom of Information Act request notifying the Bureau of Budget and Management Research that the report was 11 days past its statutory deadline.

“The recognition of revenue is a critical aspect in evaluating the CRERs each month,” said Cruz, whose letter calls for an explanation of any and all anomalies to allow for accurate comparison of revenues against prior year collections. “If these types of details are not noted with explanations, how can we guarantee that everyone is on the same page when it comes to government finances?”

As the budget season continues—and with a looming cumulative General Fund deficit of nearly $85 million, the highest deficit since before the tax refund bond was issued—Cruz continues to scrutinize monthly CRERs and other government financial reports to ensure that the public is well aware of the current fiscal situation.

“When agencies begin coming to the Legislature requesting their wish lists based on Governor Calvo’s General Fund revenue increase for FY 2017, I want them to be realistic and understanding of the current fiscal situation,” said Cruz, who noted that, for FY 2017, the Governor increased the General Fund revenue available for appropriation by almost 11 percent, resulting in a proposed $71 million in additional spending in comparison to current FY 2016 GF revenues. “During the last budget season, I received a lot of criticism from Adelup that our revenue estimates were not as aggressive as the governor would have liked, but had we not lowered the revenues and associated proposed expenditures by $40 million, we would be staring down at a larger deficit.”