Bill proposes incentive for firms that hire those with special needs

The House of Representatives would be taking up a bill that seeks to give tax incentives to businesses that hire individuals with special needs.

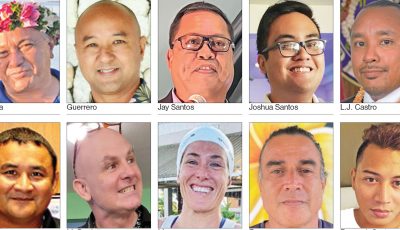

The House Ways and Means Committee has recommended House action on House Bill 20-160, authored by Rep. Lorenzo I. Deleon Guerrero (Ind-Saipan), which proposes to provide a tax credit worth $10,000 per worker to Commonwealth employers who hire those with a disability.

According to the bill, in order to qualify for the tax credit, the individual must be continuously employed by the employer for a minimum of one tax year and, in order to obtain the nonrefundable tax credit, the employer must submit to the Department of Finance Division of Revenue and Taxation a documented compliance letter for each individual issued by a medically acceptable clinic or laboratory.

Committee chair Rep. Angel A. Demapan (R-Saipan) noted during discussions on the bill that the Saipan Chamber of Commerce supports it.

Rep. Donald Barcinas (R-Saipan) pointed out a few typographical errors but, ultimately, the committee did not oppose the intent of the bill.