Bank of Hawaii posts $41.5M net income in Q2

Board of directors declares dividend of $0.45 per share

HONOLULU, Hawaii—Bank of Hawaii Corp. reported yesterday diluted earnings per share of $0.94 for the second quarter of 2014, up from $0.87 in the previous quarter and $0.85 in the same quarter last year. Net income for the second quarter of 2014 was $41.5 million, an increase of $2.9 million or 7.5 percent compared with net income of $38.6 million in the first quarter of 2014, and up $3.7 million or 9.9 percent from net income of $37.8 million in the second quarter of 2013.

Loan and lease balances increased to $6.4 billion at June 30, 2014, up 3.5 percent from March 31, 2014, and 9.7 percent compared with June 30, 2013. Deposit growth remained strong during the quarter, as balances increased to $12.7 billion at June 30, 2014, up 5.2 percent from March 31, 2014, and 10.7 percent from June 30, 2013.

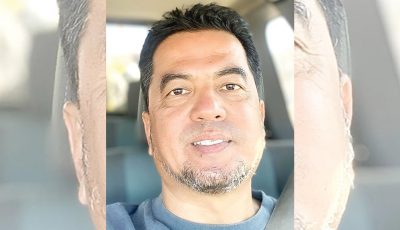

“Bank of Hawaii Corporation continued to perform well during the second quarter of 2014,” said Peter Ho, chairman, president, and CEO. “Loan balances grew and we continue to increase customer deposits. Our margin was relatively stable at 2.86 percent, asset quality continued its strong trend, and expenses remain well controlled.”

The return on average assets for the second quarter of 2014 was 1.17 percent, up from 1.12 percent in the previous quarter and during the same quarter last year. The return on average equity for the second quarter of 2014 was 15.87 percent, an increase from 15.15 percent for the first quarter of 2014 and 14.64 percent in the second quarter of 2013.

For the six-month period ended June 30, 2014, net income was $80.1 million, an increase from net income of $73.7 million during the same period last year. Diluted earnings per share were $1.81 for the first half of 2014, up from diluted earnings per share of $1.65 for the first half of 2013. The year-to-date return on average assets for the six-month period ended June 30, 2014 was 1.14 percent, up from 1.10 percent for the same six months in 2013. The year-to-date return on average equity was 15.51 percent, up from 14.37 percent for the six months ended June 30, 2013.

Total assets were $14.84 billion at June 30, 2014, up from total assets of $14.26 billion at March 31, 2014 and $13.73 billion at June 30, 2013.

Total loans and leases increased to $6.43 billion at June 30, 2014, up from $6.21 billion at March 31, 2014 and $5.86 billion at June 30, 2013.

Total deposits were $12.67 billion at June 30, 2014, up from $12.04 billion at March 31, 2014 and $11.45 billion at June 30, 2013. (BOH)