House committee: Tobacco tax hikes do reduce smoking use among youth

The House of Representatives Ways and Means Committee has determined that tobacco tax increases are one of the most effective ways to reduce smoking and other tobacco use, especially among the youth.

The Ways and Means Committee, chaired by Rep. Ray N. Yumul (Ind-Saipan), noted that, nationally, every 10% increase in cigarette prices reduces youth smoking by about 7% and total cigarette consumption by about 4%.

The committee underscored the need to increase tobacco tax collections in its recent report recommending to pass House Bill 23-7 that would amend the Commonwealth Code to increase the tax on tobacco products. The committee report was expected to be adopted at a House special session today, Wednesday.

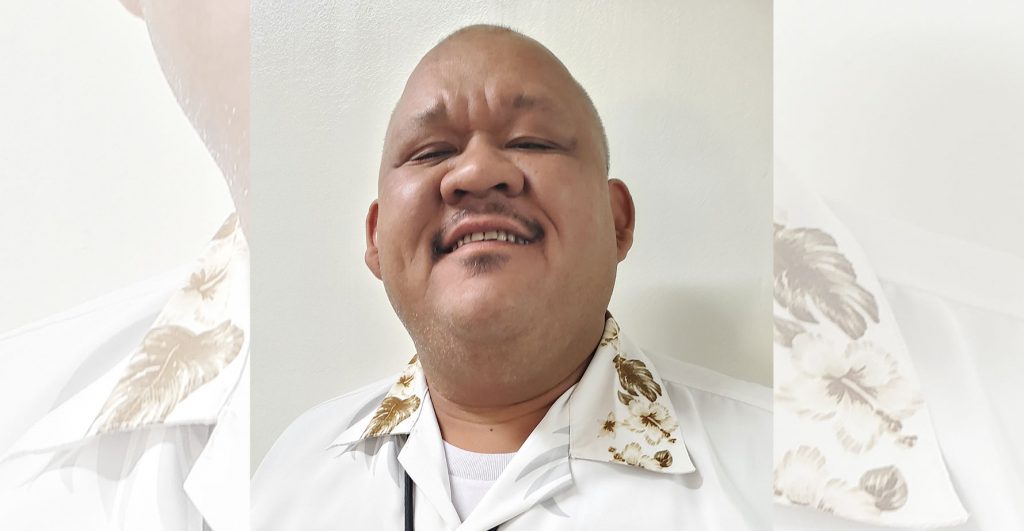

Rep. John Paul P. Sablan (Ind-Saipan) introduced the bill last Feb. 3 and it was subsequently referred to the Ways and Means Committee for disposition.

According to the committee, the potential collections for a scenario of a pack containing .45 ounces in each pack sold at a price of $8 per package would amount to approximately $4.80. If a total of 1,000 packages were sold within the CNMI a year, this would increase excise tax collections for these tobacco products by $4,800.

The committee said the CNMI’s current definition of “cigarette” under the Commonwealth Code of its excise tax laws allows for certain tobacco products to avoid the excise tax rate imposed on cigarettes.

Specifically, the committee said, tobacco products that are labelled as “cigars” or “filtered cigars,” when considering their packaging, design, intended use, and actual use, are more like cigarettes than cigars.

The committee noted that other jurisdictions have recognized “filtered cigars,” also known as “little cigars,” as cigarettes for state excise purposes, or otherwise increased the taxes imposed on these products to the same rate as cigarettes, to tax these products for what they are and appear to be, and not based solely on the labelling.

Sablan’s legislation updates the definition of “cigarette” in order to properly tax tobacco products.

The committee cited that every state that has significantly increased its cigarette tax has enjoyed substantial increases in revenue, even while reducing smoking.

The committee said higher tobacco taxes also save money by reducing tobacco-related health care costs, including Medicaid expenses.

The committee said the CNMI can realize even greater health benefits and cost savings by allocating some of the revenue to programs that prevent children from smoking and help smokers quit.

Two similar legislations were introduced and passed by the previous 21st and 22nd House.

On the bill’s cost-benefit analysis, the committee said if implemented, it will increase tobacco tax collections for a category of tobacco products that are not currently taxed.

The committee said this will apply a tax imposed on “roll your own” tobacco products purchased by consumers that they make themselves.