Student loan pause extended until Aug. 2023

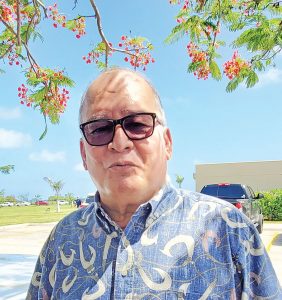

Federal student loan borrowers will not have to make payments until the end of August 2023, according to Delegate Gregorio Kilili C. Sablan (D-MP) yesterday.

Sablan announced in his e-kilili newsletter that the U.S. Department of Education announced Tuesday that if President Joe Biden’s student loan forgiveness has not been implemented and Republican lawsuits have not been resolved by June 30, 2023, payments will resume 60 days after that.

He disclosed that, along with his congressional colleagues, he urged the Education secretary to extend the pause on federal student loan payments several times.

“I welcome this news since extending the pause will reduce the financial shock of resumed payments, collections, and interest to Marianas borrowers, particularly those who qualify for and expect to receive student loan forgiveness,” Sablan said.

According to the U.S. Department of Education, the extension will alleviate uncertainty for borrowers as the Biden administration asks the U.S. Supreme Court to review the lower court orders that are preventing the department from providing debt relief of tens of millions of Americans.

U.S. Education Secretary Miguel Cardona said that callous efforts to block student debt relief in the courts have caused tremendous financial uncertainty for millions of borrowers who cannot set their family budgets or even plan for the holidays without a clear picture of their student debt obligations, “and it’s just plain wrong.”

On Aug. 24, 2022, Biden and Cardona announced plans to provide targeted student debt relief to borrowers with loans held by the Department of Education. Borrowers with annual income during the COVID-19 pandemic of under $125,000 (for individuals) or under $250,000 (for married couples or heads of households) who received a Pell Grant in college would be eligible for up to $20,000 in debt cancellation.

To date, the Department of Education said, over 26 million people have provided the department with the necessary information to be considered for debt relief, and 16 million borrowers have been approved.

But court orders are blocking the department from discharging student loan debt and accepting additional applications. Six Republican-led states filed a lawsuit last September, asserting that the Biden administration has overstepped its authority by creating such forgiveness program without going through Congress. They requested the court to stop the federal government from canceling any debt as the case proceeds.

Last month, ruling that the states lacked the standing to bring the lawsuit, U.S. District Judge Henry E. Autrey of the Eastern District of Missouri denied Republican-led states to block the administration from moving forward with the forgiveness program.

The six states then appealed the court’s ruling to the Eighth U.S. Circuit of Appeals, which recently issued a nationwide injunction temporarily preventing the administration’s student loan debt relief program.

Last week, the Department of Justice requested that the Supreme Court lift the lower court’s injunction against the program and suggested that if the court does not do so, it could take up the student debt relief case, to give borrowers the clarity and relief they are depending on.