Settlement Fund responds to HR 21-37

Editor’s Note: The following is a letter that NMI Settlement Fund administrator Lillian Pangelinan sent Rep. Joseph Lee Pan T. Guerrero in reaction to House Resolution 21-37 that he introduced in the CNMI Legislature on Sept. 22, 2020. The response is being reprinted here, with some minor edits.

Dear Rep. Guerrero: The Settlement Fund received a copy of H.R 21-37, a House resolution introduced by you, requesting the following: (1) that the CNMI government oppose the NMI District Court’s order authorizing the increase of the Settlement Fund Trustee’s hourly rate; and (2) that the Settlement Fund submit actuary and investment reports to the Legislature.

The purpose of this letter is to address certain factual misrepresentations contained in H.R. 21-37, and to remind you that all Settlement Fund reports you are seeking (including, but not limited to, Actuary Reports, Investment Reports, and Independent Audit Reports and financial statements) are available on the Settlement Fund’s website, which is updated regularly: www.nmisf.com.

Here are the Settlement Fund’s responses to certain factual misrepresentations contained in H.R. 21-37:

1. House resolution statement:

WHEREAS, on June 1I, 2019, Judge Frances Tydingco-Gatewood, District Judge of the United States District Court for the District of Guam, approved the pay raise increase of Settlement Fund Trustee Joyce C. Tang from $250 an hour to $350 an hour:

Settlement Fund response:

Ms. Tang’s request for the hourly rate increase was approved by the District Court on Dec. 12, 2019, not on June 11, 2019.

2. House resolution statement:

WHEREAS, upon rendering such orders, fudge Tydingco-Gatewood provided a 10-day period for the plaintiff, counsel for the Settlement Class, and the counsel for the CNM1 government to state their objections;

Settlement Fund response:

This statement is misleading. There is a 10-day and an annual objection period agreed upon by the CNMI government and the Class Members, set forth in Paragraph 10,2 of the Settlement Agreement (“10.2 The Trustee’s Right to Remuneration. The Trustee shall be remunerated for his services from the Settlement Fund in a reasonable amount as approved by the District Court. The CNM1, Class Counsel and Plaintiff shall have the right to timely object to any request by the Trustee for remuneration within ten days of such request or on an annual basis.”). The objection period cannot be changed without the District Court’s approval.

3. House resolution statement:

WHEREAS, Ms. Tang’s justification for her compensational increase is that it is solely based on the positive growth of the stock market, however, the growth of the stock market is not attributed to her legal services to the Settlement Fund;

Settlement Fund response:

This statement is false and misleading. Ms. Tang has never represented that the increased hourly rate was justified solely on “the positive growth of the stock,” nor has she ever taken “full credit” for the growth of stock. Today, the Settlement Fund has over $135.35 million invested—which is more than what it had at its inception in 2013. The success of the Settlement Fund is due to many factors.

Investment decisions are made by a team of professionals with a proven track record of making sound decisions. The Settlement Fund staff work tirelessly to ensure that the Settlement Fund’s accounts are properly maintained, that retirees are given prompt service, and that retirees and the government are kept fully informed of the status of the Fund and the status of their benefits. Ms. Tang and the Settlement Fund team have demonstrated single minded determination in protecting the benefits of the retirees and protecting the Settlement Fund by fighting to ensure payments owed to the Settlement Fund are made and by protecting money in the Settlement Fund from being diverted for other purposes. These combined efforts have ensured that retirees have been paid at least 75% of their benefits as required under the Settlement Agreement, and are important in expanding the life of the Settlement Fund.

4. House resolution statement:

WHEREAS, pay increases are highly unfeasible at the present time as we face this intangible force that seems to affect the entire world in one way or another;’

Settlement Fund response:

This statement is misleading. Ms. Tang’s pay rate was increased in December 2019, several months before the pandemic. She did not request a rate increase during the pandemic.

5. House resolution statement:

WHEREAS, given the specified court order and the timeliness of the pandemic, it is not in the best interest of the CNMI to be giving increases to any official who is being paid by taxpayer dollars;

Settlement Fund response:

This statement is misleading. First, Ms. Tang is not a CNMI government official. As the court-appointed Trustee, she reports exclusively to the District Court; her actions are overseen by Chief Judge Frances Tydingco-Gatewood; and all payments made to her law firm are scrutinized by the District Court.

Because payments owed to Ms. Tang’s firm are paid from funds belonging to the Settlement Fund, any payment made for her services do not impact the CNMI’s budget. As you are fully aware, the payments owed to the law firm do not increase the CNMI Government’s payment obligations under the Settlement Agreement.

6. House resolution statement:

WHEREAS, Ms. Joyce Tang currently resides on the island of Guam, which adds an additional cost to the Settlement Fund for navel, room, board, and transportation;

Settlement Fund response:

This statement is false and misleading. As of this date, her travel costs have been limited to airfare between Saipan and Guam. Ms. Tang’s firm does not charge for food expenses incurred on Saipan. All of the trips in the past few years have been day trips and no hotel charges were incurred. All costs incurred by her firm are reasonable and the reimbursement of such costs are subject to the District Court’s review and approval.

7. House resolution statement:

WHEREAS, as a cost-saving measure, it would be appropriate to appoint a legal counsel who resides within the CNMI;

Settlement Fund response:

This statement is misleading in several ways. First, the minimal extra costs of Ms. Tang being in Guam are more than offset by the benefit the Settlement Fund (and Retirees) receive from her leadership and single minded devotion to the protection of the Settlement Fund and the well-being of Retirees. Second, whatever extra costs there may be because she is in Guam are negligible. Third, as you know, the reason the District Court Judge selected a Trustee from Guam is that the candidates she considered from the CNMI all had conflicts of interest. Finally, Ms. Tang administers the Settlement Fund under the exclusive jurisdiction of the NMI District Court. The Legislature does not have the power to replace or appoint a Trustee.

8. House resolution statement:

WHEREAS, such measure, as well as the additional pay raise, can lead to additional financial resources that can be used to aid those individuals who are earning less than other recipients;

Settlement Fund response:

This statement is false and misleading. As you know, payments owed to Ms. Tang’s law firm have no bearing on benefit payments made to the Class Members (Retirees).

Class Members’ benefit payments are based on a statutory benefit formula taking into consideration the Retirees’ respective average annual salary and years in government servile. As required under the Settlement Agreement, each member is receiving at least 75% of what they are entitled to receive. As of this date, the Class Members are receiving 100% of their full benefits (i.e., 75% owed under the Settlement Agreement, plus 25% optional payment by the CNMI government)

9. House resolution statement:

WHEREAS, pursuant to the court ruling, the Settlement Fund and the CNMI government are obligated to pay 75% and 25%, respectively, of the retirees’ pension;

Settlement Fund response:

This statement is false and misleading. The Settlement Fund is obligated to pay 75% of the benefit payments. The CNMI government has the discretion (not obligation) to cover the remaining 25% balance. Ms. Tang very much appreciates the dedication of the Governor and the Lt. Governor in finding ways to continue to make the Government’s 25% contribution even in these challenging times.

10. House resolution statement:

WHEREAS, the Settlement Fund, as the largest recipient of the CNMI’s Annual Budget for the current and future fiscal years to come, along with the decreasing revenues, it would be highly appropriate to increase the Settlement Fund’s obligation to 80% payment of the retirees’ pension while decreasing the CNMI government’s obligation to 20%;

Settlement Fund response:

This is a reckless and dangerous suggestion and directly harmful to the retirees. When Ms. Tang was appointed Trustee on September 25, 2013, the experts expected the Settlement Fund to run out of money by 2019. In other words, the experts predicted there would be no money to pay retirees unless the CNMI government came up with a way to pay retirees out of each year’s current budget—an obvious impossibility.

Through the hard work of the entire Settlement Fund team, and with the support of the Governor, Lt. Governor, and Legislature, the Settlement Fund has not gone broke and is in fact in a stronger position today than when she was appointed. Part of the reason for this is that the she along with our Settlement Fund team have been ferocious in fighting off efforts by some in the government to dip into the Settlement Fund or to place added burdens on the Settlement Fund. Your suggestion that it ‘Would be highly appropriate to increase the Settlement Fund’s obligation to 80°%” without first considering the actuarial impact the increase would have on the Settlement Fund’s investment horizon (i.e., how long the Settlement Fund can make full payment before it goes broke) is exactly the type of reckless action that got the Settlement Fund into such trouble in the first place. Obviously, increasing the Settlement Fund’s obligation from 75% to 80% will deplete the Settlement Fund’s investment balance at a much quicker rate.

11. House resolution statement:

WHEREAS, this breakdown will provide better financial stability to our retirees for future years to come;

Settlement Fund response:

This is an absolutely false statement and a direct threat to the Settlement Fund and Retirees. Increasing the Settlement Fund’s obligation to 80% will not create stability and will not benefit the retirees for years to come. What it will do is lead to the Settlement Fund running out of money more quickly with the very real risk that the day will come when the government cannot pay the retirees what they are owed.

12. House resolution statement:

WHEREAS, in addition to the previously stated issues, it has been brought to our attention that our retirees have not been kept well-informed about matters concerning the settlement and that the retirees require additional time to respond to the court’s decisions;

Settlement Fund response:

This statement is untrue and a disservice to the staff of the Settlement Fund who are diligent in actively maintaining and updating the Settlement Fund’s website (www.nmisf.com/report/) with the following reports when issued:

• Trustee Reports

• Investment Consultant Reports

• Financial Reports

• Actuary Reports

• Independent Audit Reports (including Financial Statements)

• NMI District Court Orders

These reports are also filed with the NMI District Court in the Johnson v Inos case, and available to the public.

13. House resolution statement:

WHEREAS, the 10-day period to object to court decisions is insufficient and more time is highly warranted for the retirees to respond;

Settlement Fund response:

See Settlement Fund Response No. 2.

14. House resolution statement:

WHEREAS, it would be highly imperative that the Settlement Fund submit copies of the annual actuarial reports to the Legislative and Executive Branch of the CNMI government;

Settlement Fund response:

This statement is misleading and not necessary. The Settlement Fund posts all reports online at: www.nmisf.com/actuary-reports/, where they are easily accessible. Ms. Tang and I routinely speak to members of the Legislative and Executive Branches of government, all of whom seem to be familiar with the contents of the reports posted by the Settlement Fund.

15. House resolution statement:

WHEREAS, in submitting such reports, both branches of government can be made fully aware of the matters going on within the Settlement Fund and act accordingly for better effectiveness and efficiency;

Settlement Fund response:

All branches of government can be made fully aware of Settlement Fund matters by accessing the following reports on the Settlement Fund website (www.nmisf.com):

• Trustee Reports

• Investment Consultant Reports

• Financial Reports

• Actuary Reports

• Independent Audit Reports (including Financial Statements)

• NMI District Court Orders

If you, or any member of the public, are not comfortable with using websites, the Settlement Fund staff will be happy to show you how to use the Fund’s website.

16. House resolution statement:

WHEREAS, as elected officials, we cannot sit idly by and allow for such matters to take place;

Settlement Fund response:

Please take comfort in knowing that the Governor, Lt. Governor, Secretary of Finance, and some of your colleagues in the Legislature have not been idle and have been keeping current with the status of the Settlement Fund.

17. House resolution statement:

Be it resolved by the House of Representatives of the Twenty-First Northern Marianas Commonwealth Legislature that the House strongly opposes the pay raise increase of Settlement Fund Trustee Joyce C. Tang and respectfully requests the CNMI government to act on such matter;

Settlement Fund response:

H.R. 21-37 offers no factual or legal basis for the NMI government to challenge the Court’s order approving Ms. Tang’s hourly rate.

18. House resolution statement:

Be it further resolved that the House respectfully reminds the Settlement Fund and Trustee Joyce Tang to provide Actuarial Reports to both houses of the Legislature;

Settlement Fund response:

All actuary reports are available on the Settlement Fund’s website at: www.nmisf.com/actuary-reports/, and are routinely accessed by members of both houses of the Legislature. We are sorry you have not been keeping current with them.

19. House resolution statement:

Be it further resolved that the House of Representatives also insists that the Trustee issue monthly reports on the status of the Settlement Fund investments to the retirees or make them available online to the extent possible, and to provide such reports to both houses of the Legislature as well;

Settlement Fund response:

It is misleading to ask the Legislature to insist on something that the Settlement Fund has been doing every month for the past seven years. All investment reports from the Fund’s investment consultant (Wilshire) are available on its website at: https://www.nmisf.com/investment- consultant-reports-2/. The reports are uploaded monthly, dating back to December 2013. If you are not comfortable with using websites, the Settlement Fund staff will be happy to show you how to use the Settlement Fund’s website.

Highlights of Trustee’s services to Settlement Fund

The Settlement Fund currently has a balance of $135.35 million sufficient to cover more than two years of pension payments. This amount is more than what the Settlement Fund started with at its inception in 2013.

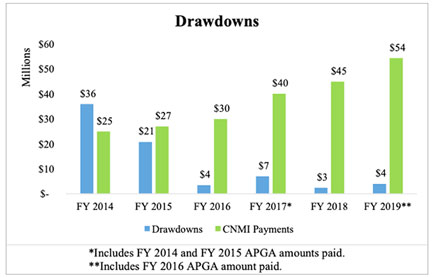

Persistently pushing NMI government to prioritize payments to the Settlement Fund and working collaboratively with the Governor, Lt. Governor, Secretary of Finance, Senate President, and House Speaker to secure a funding source and timely Minimum Annual Payments (MAP) payments and Alternative Payment a Greater Amount (APGA) to avoid a draw down on the Settlement Fund’s investments. As a result, FY 2020 marked the first time that the Settlement Fund did not have to draw down on its investments to make benefit payments. A historical schedule is provided below.

Aggressively pursued the Merrill Lynch litigation when many were urging quick settlement for small amount. Ms. Tang’s strategy resulted in a much higher settlement of $7.35 million, and netted $5.1 million for the Settlement Fund.

Ensuring that funds for the 25% benefit payment sources were properly funded.

Forged on with the CUC litigation that has since resulted in settlement.

Successfully intervened in the ongoing PSS case to protect the Settlement Fund’s position and priority with the CNMI’s budget.