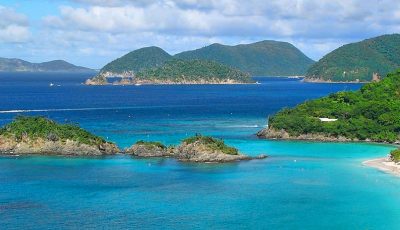

$251M in rum tax payments released to USVI

WASHINGTON, D.C.—The U.S. Department of the Interior will be signing over $251 million to the U.S. Virgin Islands in rum tax cover-over payments for the estimated fiscal year 2019 rum tax collections in the U.S. Virgin Islands.

“The Virgin Islands government relies on receiving these funds as quickly as they are available,” said Interior Secretary Ryan Zinke yesterday. “This is one way that my Interior team and I continue to provide necessary and beneficial support to the people of the USVI.”

Under the Revised Organic Act of the Virgin Islands (48 USC 1541), any excise tax collected on USVI manufactured rum imported into the United States is transferred to or “covered-over” to the USVI.

The USVI government submits an advance estimate of rum excise taxes to the Department of the Interior’s Office of Insular Affairs on an annual basis so that a payment can be made in September of each fiscal year. Any adjustments necessary are calculated based upon amounts advanced from rum excise taxes derived from the USVI and actual receipts collected by the federal government.

“A similar advance payment of $223,925,000 was announced by Secretary Zinke for the USVI in September of last year for fiscal year 2018,” noted Doug Domenech, assistant secretary, Insular and International Affairs. “Any adjustments necessary for 2018 will be calculated by OIA and processed quickly in the Spring of 2019, once we receive the actuals from Treasury.” (DOI)